New York State tax? New York State has a complex tax system that includes various taxes, such as income tax, sales tax, property tax, and others. Here’s an overview of some of the key taxes in New York State:

- New York State Income Tax: New York State imposes a progressive income tax, which means that the tax rate increases as your income goes up. The tax rates vary depending on your filing status (single, married, head of household, etc.) and your income level. As of my last knowledge update in 2021, the tax rates ranged from 4% to 8.82% for the highest earners.

- New York City Income Tax: If you live in New York City, you are subject to both New York State income tax and New York City income tax, which is an additional tax on top of the state tax. The New York City income tax rates also vary based on income.

- Sales Tax: The statewide sales tax rate in New York State is 4%, but individual counties and cities may impose additional local sales taxes, making the total sales tax rate higher in some areas. The local sales tax rate varies by location.

- Property Tax: Property taxes in New York State are primarily assessed and collected by local governments, including cities, towns, and school districts. Property tax rates can vary significantly depending on the location, property value, and local tax policies.

- Estate Tax: New York State has an estate tax that applies to estates with a value exceeding a certain threshold. The exemption threshold and tax rates can change over time, so it’s important to check the current rules if you’re concerned about estate taxes.

- Other Taxes: New York State also levies taxes on things like cigarettes, alcoholic beverages, and motor vehicle registrations, among others.

It’s important to note that tax laws and rates can change, so it’s advisable to consult with a tax professional or refer to the New York State Department of Taxation and Finance website for the most up-to-date and detailed information on New York State taxes. Additionally, individual circumstances, such as your income, deductions, and residency status, can impact your tax liability, so it’s essential to seek personalized tax advice when necessary.

New york state tax refund :If you are expecting a tax refund from the state of New York, you can check the status of your refund by visiting the New York State Department of Taxation and Finance website. They provide an online tool where you can track the progress of your refund. Here’s how to do it:

- Visit the New York State Tax Department Website: Go to the official website of the New York State Department of Taxation and Finance (https://www.tax.ny.gov/).

- Select “Check Refund Status”: Look for an option or link on the website that allows you to check the status of your refund. It’s usually labeled something like “Check Refund Status” or “Where’s My Refund?”

- Provide the Required Information: You will typically need to enter your Social Security Number (or ITIN), the amount of the refund you are expecting, and the filing status used on your tax return.

- Submit the Information: After entering the required information, submit the form or request to check your refund status.

- View Your Refund Status: The website will provide you with the current status of your refund. This status could indicate that your refund has been processed, is pending, or may require further review.

Keep in mind that it may take some time for your refund to be processed, and the exact processing time can vary depending on factors such as the filing method (e-filed or paper return) and the complexity of your tax return.

If you have specific questions about your New York State tax refund or encounter issues with the process, you can contact the New York State Department of Taxation and Finance directly for assistance. They will be able to provide you with personalized information and support related to your refund.

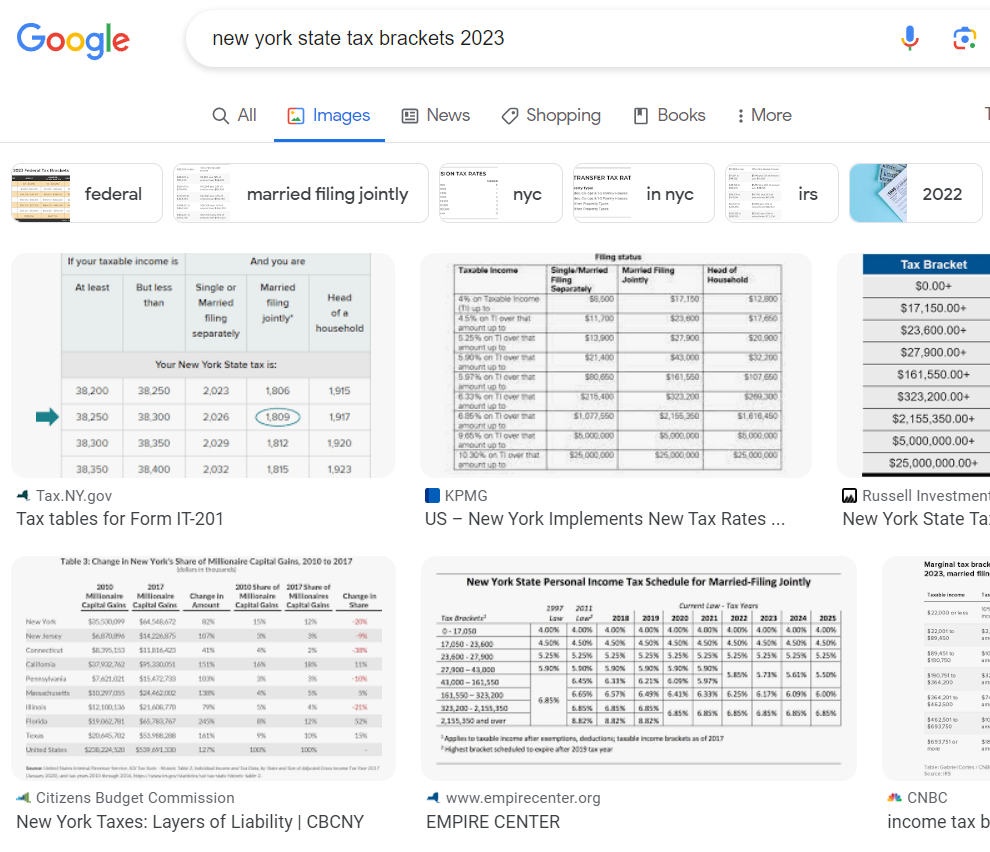

New york state tax rate : As of my last knowledge update in September 2021, New York State had a progressive income tax system with tax rates ranging from 4% to 8.82%. The tax rates were based on your filing status and income level. Here’s a general overview of the income tax rates for New York State as of that time:

- For Single Filers:

- 4% on income up to $8,400

- 4.5% on income between $8,401 and $11,600

- 5.25% on income between $11,601 and $13,750

- 5.9% on income between $13,751 and $21,150

- 6.09% on income between $21,151 and $80,650

- 6.41% on income between $80,651 and $215,400

- 6.85% on income between $215,401 and $1,077,550

- 8.82% on income over $1,077,550

- For Married Individuals Filing Jointly:

- 4% on income up to $16,700

- 4.5% on income between $16,701 and $23,200

- 5.25% on income between $23,201 and $27,450

- 5.9% on income between $27,451 and $42,450

- 6.09% on income between $42,451 and $161,550

- 6.41% on income between $161,551 and $323,200

- 6.85% on income between $323,201 and $2,155,350

- 8.82% on income over $2,155,350

Please note that these rates are subject to change, and the New York State legislature can modify them. Additionally, New York City imposes its own income tax on top of the state income tax for residents of the city.

For the most current and specific tax rate information, it’s essential to consult the New York State Department of Taxation and Finance website or seek advice from a tax professional. Tax rates can change due to legislative decisions, so the rates may be different in the year you file your taxes.

To calculate your New York State income tax, you can use the New York State Department of Taxation and Finance’s official online tax calculator or use tax preparation software that includes New York State tax calculations. Here’s how to use the official online calculator:

- Visit the New York State Department of Taxation and Finance Website: Go to the official website of the New York State Department of Taxation and Finance (https://www.tax.ny.gov/).

- Navigate to the Tax Calculator: Look for a section on the website related to tax calculators. It may be labeled as “Income Tax Calculator” or something similar.

- Enter Your Tax Information: Use the calculator to enter your tax information, which may include your filing status, income, deductions, and any credits you are eligible for.

- Calculate Your Tax: After entering all the necessary information, click the “Calculate” or “Compute” button to determine your estimated New York State income tax liability.

- Review the Results: The calculator will provide you with an estimate of your New York State income tax liability based on the information you provided.

Keep in mind that the calculator provides an estimate and may not account for all possible tax situations, deductions, or credits. It’s always a good idea to double-check your tax calculations and consult with a tax professional or use tax preparation software if your tax situation is complex.

Additionally, be aware that tax laws and rates can change from year to year, so the calculator will reflect the rates and rules in effect for the tax year you specify. Make sure to use the correct year when using the calculator for a specific tax year.

Filing a New York State tax return is a process that residents and non-residents of New York State must follow to report their income and determine their state income tax liability. Here are the general steps to file a New York State tax return:

- Gather Your Tax Documents: Collect all the necessary tax documents, including your W-2 forms, 1099 forms, and any other income-related documents. You’ll also need documentation for deductions and credits, such as receipts for itemized deductions or proof of eligibility for specific tax credits.

- Choose Your Filing Method:

- Online Filing: The New York State Department of Taxation and Finance offers free electronic filing (e-file) options on their website. You can use their official website or certified tax software to file electronically.

- Paper Filing: If you prefer to file a paper return, you can download the appropriate forms and instructions from the New York State Department of Taxation and Finance website, complete them, and mail them to the address provided.

- Complete Your Tax Return: Fill out your New York State tax return following the instructions provided with the tax forms. Be sure to accurately report your income, deductions, and credits.

- Calculate Your Tax Liability: Use the tax tables or tax calculation method provided in the instructions to determine your New York State income tax liability.

- Submit Your Return:

- If filing electronically, follow the instructions on the official website or tax software to e-file your return.

- If filing a paper return, ensure you include all required forms, schedules, and attachments. Mail your completed return to the address specified in the instructions.

- Pay Any Tax Owed: If you owe state income tax, you must include payment with your return. You can pay electronically or include a check or money order payable to the “New York State Department of Taxation and Finance.”

- Track Your Refund: If you’re expecting a tax refund, you can check the status of your refund using the New York State Department of Taxation and Finance’s online tool.

- Keep Copies of Your Return: Make copies of your completed tax return, all attachments, and any payment documentation for your records. It’s a good practice to keep tax records for several years.

- File on Time: Ensure you file your New York State tax return by the deadline. The due date typically corresponds with the federal tax deadline, which is usually April 15th. However, deadlines can change, so check the official New York State tax website for the most current information.

- Seek Professional Assistance if Needed: If your tax situation is complex or you have questions about your New York State tax return, consider consulting a tax professional or using tax preparation software for assistance.

Please note that tax laws and regulations can change, so it’s important to refer to the official New York State Department of Taxation and Finance website or consult with a tax professional for the most current information and guidance related to filing your state tax return.

To access your New York State tax account and perform tasks such as filing your state tax return, making payments, and checking your refund status, you’ll need to create an online account on the New York State Department of Taxation and Finance website. Here’s how to do it:

- Visit the New York State Department of Taxation and Finance Website: Go to the official website of the New York State Department of Taxation and Finance (https://www.tax.ny.gov/).

- Register for an Online Account:

- Look for a section on the website that allows you to create an online account or log in. It may be labeled as “Online Services” or something similar.

- Click on the “Create Account” or “Register” button to begin the registration process.

- Provide Personal Information:

- You will be prompted to enter personal information, such as your name, Social Security Number, date of birth, and contact information.

- Follow the on-screen instructions to complete the registration process. You may also need to create a username and password for your account.

- Verify Your Identity: The Department of Taxation and Finance may use various methods to verify your identity to ensure the security of your tax information.

- Access Your Account: Once you’ve successfully registered and logged in, you’ll have access to your New York State tax account. From there, you can perform various tax-related tasks, including filing your state tax return, making payments, and checking your refund status.

- Remember to Log Out: After using your online account, be sure to log out to protect your personal and tax information.

If you encounter any difficulties during the registration process or while using your online account, you can contact the New York State Department of Taxation and Finance for assistance. They may also have resources and FAQs on their website to help you navigate the online services.

new york city tax,New York City imposes several taxes and fees on its residents and businesses to fund various city services and initiatives. Here are some of the key taxes and fees in New York City:

- New York City Income Tax: In addition to New York State income tax, residents of New York City are subject to a local income tax. The tax rates vary depending on your income and filing status. The New York City income tax is collected by the New York State Department of Taxation and Finance.

- Property Tax: Property owners in New York City are subject to property taxes. The amount you owe in property tax is determined by the assessed value of your property and the property tax rate set by the city.

- Sales Tax: New York City imposes a combined state and local sales tax rate that varies depending on the type of goods or services being purchased. As of my last knowledge update in September 2021, the sales tax rate in New York City was 8.875%. However, this rate can change, so it’s essential to check the current rate.

- Real Property Transfer Tax: When real estate is bought or sold in New York City, a transfer tax is imposed. The rate depends on the purchase price of the property.

- Hotel Occupancy Tax: Visitors staying in hotels in New York City are subject to a hotel occupancy tax. This tax is added to the cost of the hotel room.

- Commercial Rent Tax: Certain businesses in Manhattan south of 96th Street are subject to the Commercial Rent Tax (CRT). It is a tax on the rent paid for commercial property.

- Cigarette and Tobacco Taxes: New York City has high taxes on cigarettes and other tobacco products, making them more expensive within the city.

- Unincorporated Business Tax (UBT): Some unincorporated businesses in New York City may be subject to the Unincorporated Business Tax. This tax is based on the net income of the business.

- Utility Taxes: There are various taxes and surcharges on utility bills, including electricity, gas, and telecommunications services.

- Other Fees and Taxes: New York City may impose other fees and taxes for specific purposes, such as a plastic bag fee or a surcharge on ride-sharing services.

It’s essential to note that tax rates and regulations can change over time, and the information provided here is based on my last knowledge update in September 2021. If you have specific questions about taxes in New York City or need up-to-date information, I recommend consulting the official website of the New York City Department of Finance or seeking advice from a tax professional. Additionally, some taxes, such as property tax, may vary depending on the specific location within New York City.

| Income | Tax Rate |

|---|---|

| $0 to $8,500 | 4% |

| $8,501 to $11,700 | $340, and 4.5% of income over $8,500 |

| $11,701 to $13,900 | $484, and 5.25% of income over $11,700 |

| $13,901 to $80,650 | $600, and 5.85% of income over $13,900 |